House prices show growth year on year

Key takeaways: April 2025 House Prices

- House prices in the West Midlands rise : 2.3% year on year ( Zoopla April 25 ) & by 1% ( Rightmove April 25 ) the average asking price of home hits a new record, at just over £261,316

- Our snapshot of the housing market after stamp duty increase suggests people are carrying on with their home moves

- New home-buyer demand is up 5% compared to last year, with new sellers coming to market up by 4% ( Rightmove April 25 )

- Mortgage rates may drop more quickly than anticipated if the Bank of England reduces the Base Rate in May

As the days get longer, Spring is in full bloom and the weather improves so does the property market, with more home-movers springing into action. This year, we’ve seen some more substancial changes in the market than usual, with for example the temporary stamp duty holiday ending from the start of April.

But the latest snapshots of the housing market shows that most people are moving on as normal, indeed this first quarter, here at Acres we have been pleasantly surprised, and very pleased by the levels of Sales and New Instruction coming to market with sales to the end of March, our year end, being 41% higher than the previous year, listings 18% higher, and properties completed once more 41% higher, a great year.

You can check the average prices in the region by viewing Rightmove’s House Price Index report for April and also the latest sold prices in your area here.

What is the reason for price increases ?

Traditionally we see increases in the Spring, when the housing market is at its busiest. However, this month’s jump is bigger than the usual price rise we see in April.

This is because demand from those looking to buy a home is up by 5% compared to this time last year, while the number of new sellers coming to market has also increased by 4%. ( data from Rightmove )

Nigel Deekes – founding Partner of Acres comments : “ It has been an exceptionally busy 12 months, the market has moved forward, as have Acres, once more proportionally taking more New instruction and Sales from the stock of property in the area. We’ve seen our prices move forward marginally, and the anticipated slow down from the withdrawal of the stamp duty savings impacting the market less than expected, as the general additional £2,500 payable perhaps not being as big a deterrent as expected, given the average price of a property in the area the stamp duty increase proportionally has less impact and desire for many to move remains strong, life goes on. “

Chris Deekes - Associate Partner, and managers of Acres Great Barr " Since the recent stamp duty changes, we haven’t seen an increase in the number of home sales falling through, which indicates there hasn’t been a backtracking from buyers who were unable to complete before the tax rise. There was also a significant rush to complete sales before the April deadline."

With more homes available for sale than at this time last year, there’s more competition, so it’s really important if you’re thinking of selling your home to work with your agent to get the price right.

Chris Harvey Managers of Acres Four Oaks explains: “March was a very busy month, with significantly more completions than usual. We, and solicitors worked very hard to get so many sales through. April has started off as a busy month, with instructions up, as are viewings and offers across all of four North Birmingham offices.”

What’s happening with mortgage rates?

Rightmove analysis shows Average mortgage rates remain just below 5%, with the current average five-year fixed mortgage rate of 4.72% being only slightly lower than this time last year. If the Bank of England opts for further and faster rate cuts, starting in May, then mortgage rates could drop more quickly than anticipated. You can check the current average mortgage rates here.

Know your mortgage bughet in 2 minutes :

- Discover your maximum borrowing power https://acres-fs.co.uk/aea-mortgage-borrow-calculator

- Establish your monthly repayments https://acres-fs.co.uk/aea-mortgage-repayment-calculator

- See homes you know you can afford www.acres.co.uk

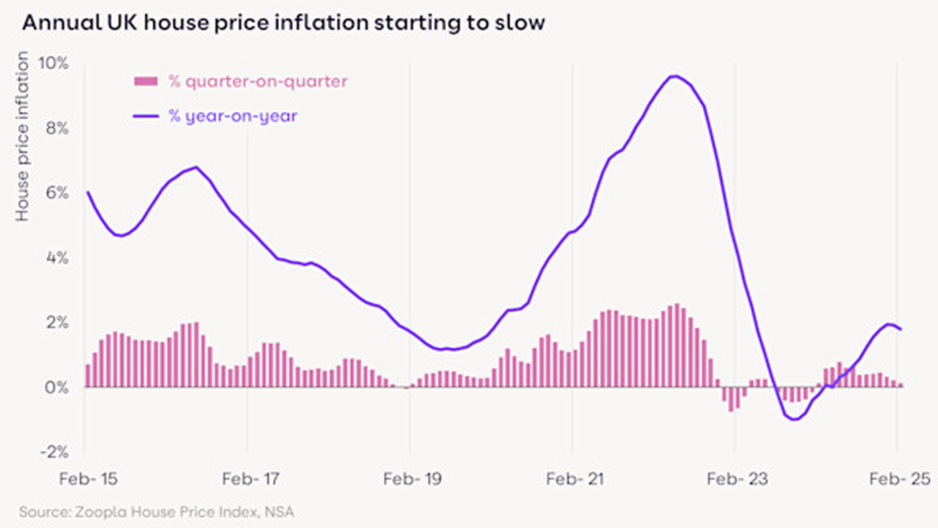

House price inflation slows as supply grows

House price inflation is still relatively slow after a good recovery over the last 12 months. The annual rate of UK house price inflation edged lower in February to 1.8%.

Prices are still rising faster than a year ago (-0.2%) but we expect the rate of UK house price inflation to moderate in the coming months. ( Data from Zoopla )

There are several factors behind the expected slowdown. The number of homes for sale is growing faster than the number of sales being agreed, boosting choice for buyers and re-enforcing a buyers’ market.

While house price inflation is slowing, the number of sales agreed continues to increase, up 5% on a year ago, with demand 10% higher.

Lettings News

Annabelle Reynolds, Acres lettings manager comments : “ In March 2025, the UK's residential rental market is experiencing significant growth, with rental prices expected to increase considerably. This growth is projected to continue through 2029, with a cumulative increase of nearly 18%. Specifically, the UK rental market is poised for a surge, with a robust eight percent rise anticipated in 2024. Additionally, the {"How to Rent" guide https://www.mydeposits.co.uk/content-hub/how-to-rent-guide/} is a crucial resource for landlords, outlining the legal requirements for renting out properties. Landlords must ensure their properties are in compliance with the latest version of the guide, which includes providing adequate insurance, checking smoke and carbon monoxide alarms, and ensuring valid gas safety certificates, EICRs, and EPC"

Want to check how much your home is worth? You can get an Instant Valuation here.

If you would like to discuss selling your home, please get in touch with us This email address is being protected from spambots. You need JavaScript enabled to view it. or call any of our busy, helpful teams/offices:

Four Oaks 0121 323 3088

Sutton Coldfield 0121 321 2101

Walmley 0121 313 2888

Great Barr 0121 358 6222

Lettings 0121 312 4997

Mortgages 0121 387 1616

Thank you for reading this article, and your interest in Acres and our property for sale.

Nigel & Jayne Deekes – Acres Partners